What types of business entities are there for Japan business?

Representative offices are established as locations for carrying out preparatory and supplemental tasks aimed at enabling foreign companies to engage in full-scale business operations in Japan. These offices may conduct market surveys, collect information, purchase goods and implement publicity/advertising efforts, but they are not permitted to engage in sales activities. The establishment of representative offices does not require registration. A representative office cannot ordinarily open bank accounts or lease real estate in its own name, so agreements for such purposes must instead be signed by the head office of the foreign company or the representative at the representative office in an individual capacity.

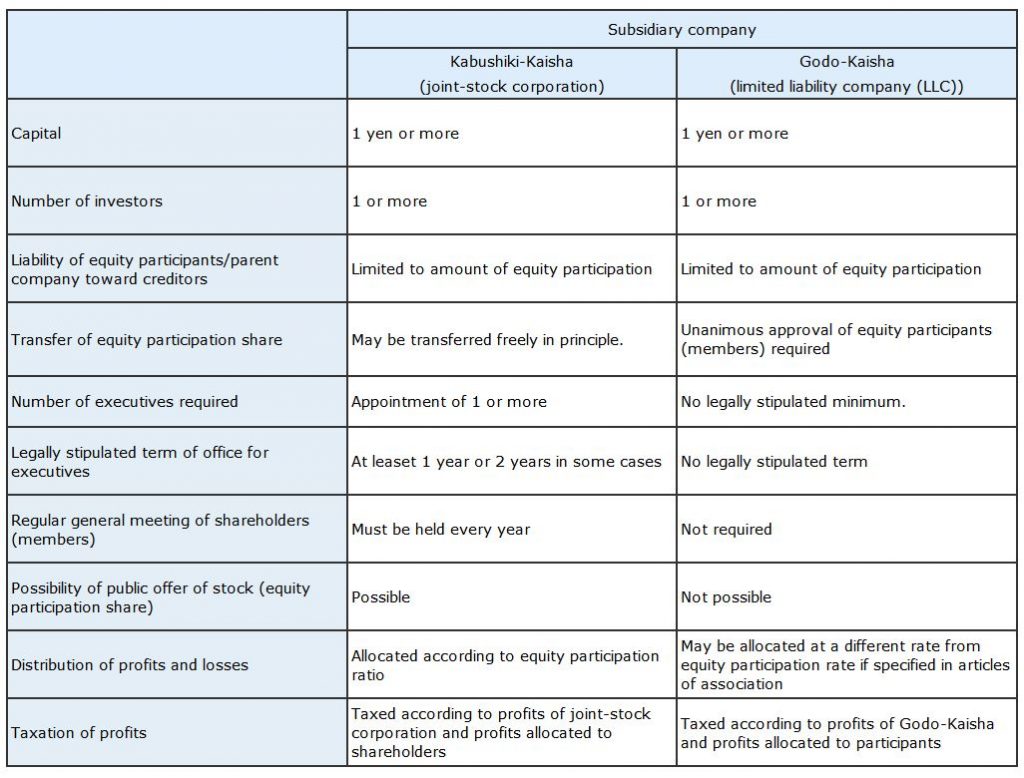

A foreign company wishing to engage in continuous business transactions in Japan must register the office/entity in Japan. There are basically two types of subsidiary companies in Japan: joint-stock corporation (Kabushiki-Kaisha (K.K.)) and limited liability company (Godo-Kaisha). A subsidiary is a separate corporation from the foreign company; the foreign company will bear the liability of an equity participant stipulated by law for all debts and credits generated by the activities of the subsidiary. Joint-stock corporations and limited liability companies are similar insofar as liability in them is limited to the assets contributed by equity participants. Compared with joint-stock corporations, limited liability companies have greater freedom of self-government through their articles of association and, unlike joint-stock corporations, they may stipulate the procedures for preparing and approving their financial statements in their articles of association as there are no laws and regulations relating to finalizing annual financial statements and do not have to publish their financial results.